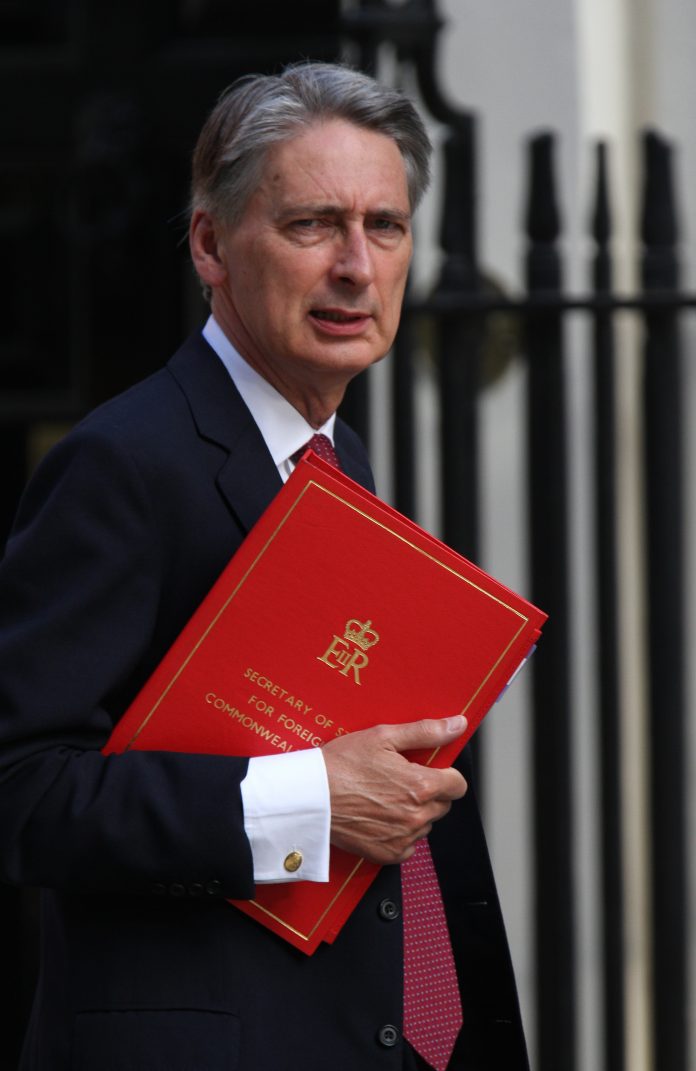

Following the delivery of Philip Hammond’s highly-anticipated second Autumn budget as chancellor, we’ve summarised some of the key points to take from his speech.

Brexit Budget

- £2.3 billion to enact changes to CPI from RPI brought forward to 2018.

- Following the next revaluation, future revaluations to take place every three years.

- Staircase tax: businesses affected will have original bill reinstated.

- Discount for pubs (with a value below £100,000) extended by one year to March 2019.

Personal Tax

- Tax-free personal allowance to rise to £11,850 by April 2018

- Higher-rate tax threshold to rise to £46,350

The NHS

During his speech, the Chancellor announced the allocation of £2.8 billion to the NHS in England.

- Stamp duty to be abolished for first-time buyers purchasing properties worth up to £300,000

- In London and more expensive regions, the first £300,000 of the cost of a £500,000 purchase by first-time buyers will be exempt from stamp duty

- 80 percent of all first-time buyers will not pay stamp duty

- Target of 300,000 homes to be built yearly by the mid-2020s

- £44 billion pledged in government support inc. loan guarantees, to boost construction skills

- 100 percent percent council tax premium on empty properties

- A commitment to end rough sleeping by 2027

Grenfell Tower

£28 million for Kensington and Chelsea council to provide counselling services and mental health support for victims, and to support regeneration efforts of the surrounding area.

The Northern Powerhouse

- Chancellor announces £30m to improve digital connectivity on the trans-Pennine route.

- A New city deal for the West Midlands

“…we back #NorthernPowerhouse, #MidlandsEngine & elected mayors across UK with a new £1.7 billion Transforming Cities Fund” #Budget2017 pic.twitter.com/IJ5ExHLFG6

— HM Treasury (@hmtreasury) 22 November 2017

https://platform.twitter.com/widgets.js

Stamp Duty

Hammond looks to aiding the younger generation and first-time buyers. As a result, Stamp Duty abolished for first-time buyers on homes up to £300,000, and on the first £300,000 of properties up to £500,000.

In addition, as part of a bid for the conservative government to win over younger voters, Hammond also announced a New Railcard extended to 30 years old.

Duties on Wine, Spirit and Beer

Duty on beers, wine, spirits to be frozen. Merry Christmas says @PhilipHammondUK #Budget2017

— Investment Observer (@InvtObserver) 22 November 2017

https://platform.twitter.com/widgets.js

For the full details of the Autumn budget 2017, see here.